Providing the right sales incentive can mean the difference between motivated agents and lost revenue. If you’re looking for ways to jumpstart your sales team to meet your targets, the spiff incentive is a great option to explore.

What is a spiff incentive?

The meaning is in the acronym “SPIFF,” which stands for “Sales Performance Incentive Fund.” Spiffs are incentives that reward sales representatives for making quick sales, often given in the form of reloadable cards. This payment strategy is typically used in short-term business promotions, such as launching a new product or selling off inventory.

When motivated by a spiff, salespeople can focus on selling a specific product or service rather than juggle an entire client base or sales cycle. For that reason, spiffs are effective at re-engaging sales representatives who may not be top performers in regular promotions or who may be behind on reaching their sales goals. Additionally, reps who work in geographic locations with lower demand still have the opportunity to be rewarded for their efforts with a spiff.

Employee satisfaction is also a widespread issue that spiffs can improve. On average, 68% of employees are either unengaged or actively disengaged in their jobs. With employee disengagement levels at such high rates, a spiff program instills enthusiasm and motivation in the workplace, with the potential to increase sales by as much as 27%.

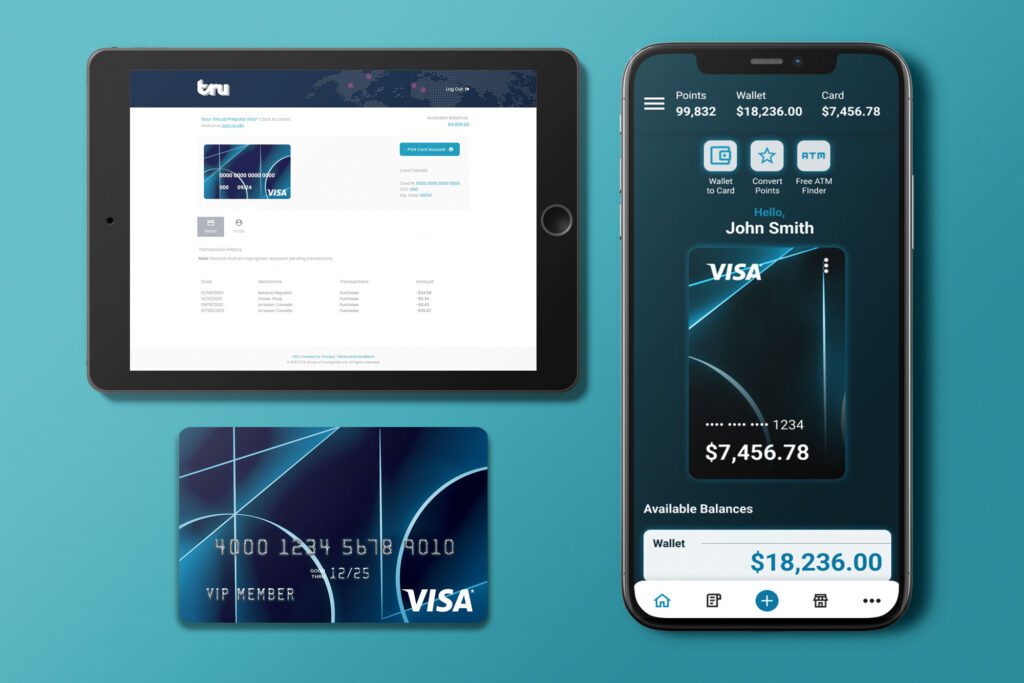

So how can you offer spiffs? Prepaid cards are the most practical and convenient solution for spiff programs because recipients can use their cards at any retail store, online merchant or ATM that accepts credit cards. Plus, the cards can be branded with your company logo, serving as free advertising and a reminder of your business’s goodwill.

Example of a prepaid card and portal made by Tru

What’s the difference between a spiff and a commission?

Commissions and spiffs are both performance payments, but spiffs are for temporary use and commissions are more permanent incentives. Spiffs are also paid to salespeople quickly as one-time bonuses for selling a specific product or service. Conversely, commissions are given once employees meet a sales target over time, such as quarterly or yearly. Although commission percentages vary across industries and countries, the average sales commission is about 40% incentive pay with a 60% fixed salary, yet spiffs can be any set amount.

When Should You Use a Spiff Program?

….

1. For Short Term Gains

First, you should outline the goals for your performance pay program and set a timeframe. If your goal requires prompt action, like boosting sales on a specific product, a spiff promotion is ideal because of its immediate reward system. However, if your top priority is building customer relationships or selling over longer timelines, loyalty incentives and commissions are better suited.

2. If You Have the Budget

It’s also important to consider the financial commitment required if your spiff program is a success, because this payment type is highly motivating. Plan for the best-case scenario, so if all your sales reps generate plenty of leads, your company can pay them promptly and keep morale up.

3. If You Can Manage Them Closely

Due to the time-sensitive nature of this strategy, spiffs require careful planning and management. If you run multiple promotions simultaneously, it may be difficult to track each sale and payment, and some representatives may delay making sales. To solve this issue, implement a digital program to streamline rewards, saving you time and administrative costs. As an example, Tru’s mobile wallet app and virtual card eliminate the inconvenience of cash or cheque incentives and provide useful data to optimize future promotions.

Ready to drive instant sales performance with spiff prepaid cards? Contact us today to get started.

Nikko Pangilinan

Nikko Pangilinan Ray Forzley

Ray Forzley Diana Marie

Diana Marie Lisette Anciaes

Lisette Anciaes Junius Cheng

Junius Cheng  Aysha Shahid

Aysha Shahid Chris Michaelis

Chris Michaelis Mira Tzur

Mira Tzur Jamie Rust

Jamie Rust Dianne Dickens

Dianne Dickens Roy Murad

Roy Murad Huguette Masse

Huguette Masse Lauren Weekes

Lauren Weekes