Introduction

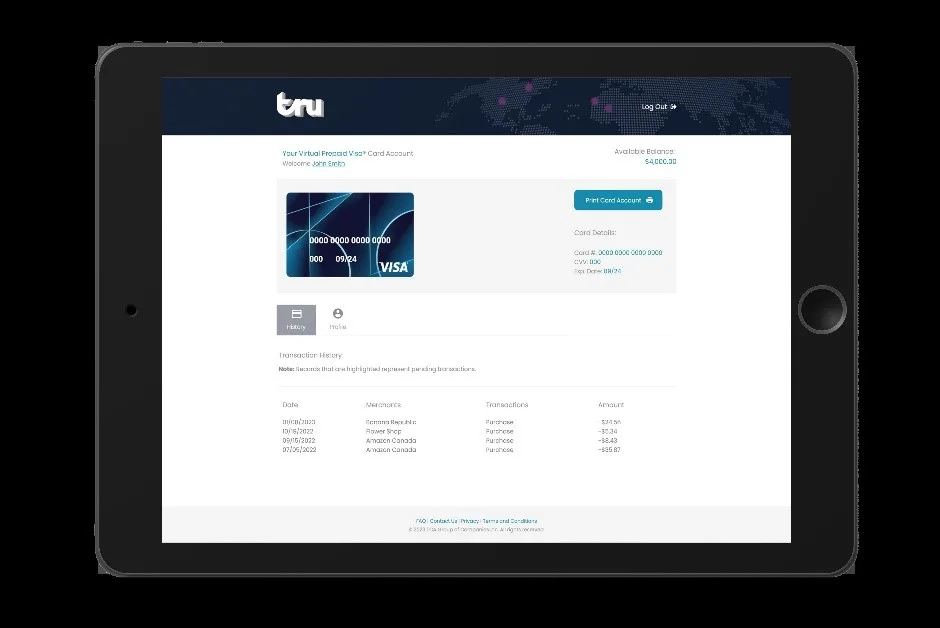

Closed loop payment programs offer businesses and organizations a convenient way to manage and track transactions within their own ecosystem. To ensure greater control over purchase activity, closed loop payment programs often rely on Merchant Category Codes (MCC codes) as a powerful tool. In this article, we will delve into the world of MCC codes and explore how they can help restrict purchase activity for closed loop payment programs. What are MCC Codes? Merchant Category Codes (MCC codes) are four-digit numbers assigned to businesses by the payment card networks, such as Visa, Mastercard, and American Express. Each MCC code represents a specific category or industry to classify the type of goods or services provided by a merchant. These codes are essential for processing transactions accurately and efficiently within the payment ecosystem.

Role of MCC Codes in Closed Loop Payment Programs

Closed loop payment programs operate within a restricted network, allowing transactions only within a designated group of merchants. These programs are often tailored to meet the specific needs of businesses, organizations, or institutions, such as employee expense management, gift cards, or university campus cards. MCC codes play a vital role in closed loop payment programs by providing a mechanism to enforce purchase restrictions. By associating MCC codes with authorized merchants, program administrators can control where funds can be spent and limit transactions to specific categories or industry segments. This helps businesses ensure compliance with their internal policies and regulations, manage budgets effectively, and prevent unauthorized or inappropriate spending.

Implementing MCC Codes for Purchase Restrictions

To restrict purchase activity within closed loop payment programs, administrators can set up rules based on MCC codes. Here’s how it works:

The first step involves assigning appropriate MCC codes to each authorized merchant within the closed loop program. These codes are typically obtained from the payment card networks or other reliable sources that maintain an updated list of MCC codes.

- Categorizing Merchants

The first step involves assigning appropriate MCC codes to each authorized merchant within the closed loop program. These codes are typically obtained from the payment card networks or other reliable sources that maintain an updated list of MCC codes. - Defining Purchase Restrictions

Administrators can establish purchase restrictions by defining which MCC codes are allowed or prohibited for transactions within the program. For example, a university campus card program may allow transactions only at MCC codes associated with education-related expenses like books, supplies, and cafeteria services, while disallowing purchases at MCC codes for luxury goods or alcohol. - Setting Spending Controls

MCC codes can also be used to enforce spending limits or control the frequency of transactions. Program administrators can define maximum spending thresholds for specific MCC codes, ensuring responsible use of funds and preventing excessive or unauthorized purchases.

The second step is determining the benefits of MCC Codes in Closed Loop Payment Programs:

- Enhanced Control and Compliance

MCC codes provide administrators with granular control over purchase activity, allowing them to align spending with program objectives and policies. By restricting transactions to specific categories, businesses and organizations can ensure compliance, reduce fraud risks, and prevent misuse of funds. - Budget Management and Expense Tracking

Closed loop payment programs rely on accurate expense tracking and budget management. MCC codes enable administrators to monitor spending patterns across different categories, analyze expense reports, and gain valuable insights for financial planning. - Tailored User Experience

By utilizing MCC codes, closed loop payment programs can provide a tailored and seamless user experience. Participants within the program can make purchases confidently, knowing that their transactions align with the program’s intended purposes and guidelines.

Conclusion

Merchant Category Codes (MCC codes) are instrumental in managing and restricting purchase activity within closed loop payment programs. By leveraging these codes, administrators can exert precise control over authorized merchants, enforce spending limits, and ensure compliance with internal policies. MCC codes offer businesses, organizations, and institutions the flexibility to design payment programs that align with their specific needs, enhancing control, efficiency, and transparency in financial transactions.

Contact us to grow your business through the power of intelligent loyalty.

Nikko Pangilinan

Nikko Pangilinan Ray Forzley

Ray Forzley Diana Marie

Diana Marie Lisette Anciaes

Lisette Anciaes Junius Cheng

Junius Cheng  Aysha Shahid

Aysha Shahid Chris Michaelis

Chris Michaelis Mira Tzur

Mira Tzur Jamie Rust

Jamie Rust Dianne Dickens

Dianne Dickens Roy Murad

Roy Murad Huguette Masse

Huguette Masse Lauren Weekes

Lauren Weekes