Virtual prepaid cards give the benefits of physical cards in a digital format. Like physical prepaid cards, virtual versions have a 16-digit number with a CVV number attached. They’re also valid to use at any online merchant where Visa® and MasterCard® are accepted, providing customers with spending freedom. Ultimately, virtual cards improve the e-commerce shopping experience with safety and convenience.

How are virtual prepaid cards loaded & delivered?

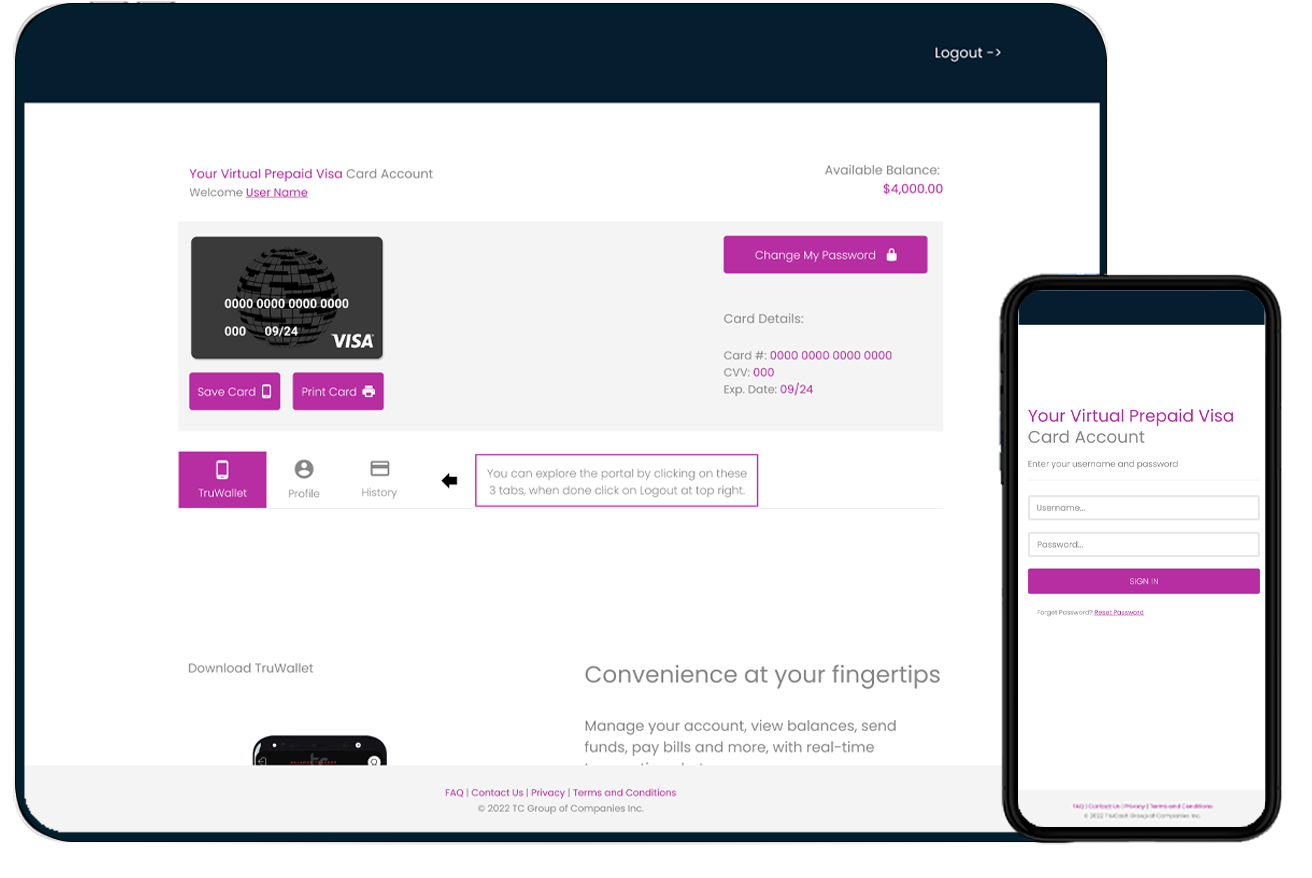

Issuers, who are typically employers or merchants, load the cards by sending funds electronically. The cards are then sent to a recipient list by email that links to a quick-launch screen. From there, cardholders use a mobile app or online portal to see their current balance and transaction history.

Since virtual cards aren’t tangible, they don’t require manufacturing or printing and can be distributed across the globe instantly. From designing the card art to issuing them, the delivery process is typically 3 to 4 weeks, as opposed to 6 to 8 weeks for physical card production.

What are the benefits of virtual cards?

1. No ATM transaction fees

2. Build brand awareness with customization

3. Easy online shopping

4. Deliver funds instantly

5. Reduced fraud

Virtual prepaid cards have many benefits for both issuers and cardholders. Firstly, they can be given as vouchers or gift cards and co-branded with corporate logos, acting as permanent advertisements. This allows customers to develop positive feelings toward your brand by using the card or mobile app.

Other perks include avoiding ATM fees, reducing the risk of fraud since prepaid cards don’t connect to bank accounts, and saving on production costs. Plus, they allow companies to launch promotions in less than a month’s time or manage multiple promotions virtually.

What are the downsides to virtual cards?

When are virtual cards not right for your business? Well, they’re inaccessible by ATM and only reloadable by the issuer, so you can’t withdraw cash or transfer funds from your bank account. Further, accessing the cards for online purchases also requires extra steps. This includes inputting login details on a mobile app rather than just swiping at the store. Finally, balances usually limit to $2500 (depending on the card provider), preventing users from making larger purchases.

How can companies use prepaid cards?

1. Corporate incentive programs

2. Marketing and sweepstake campaigns

3. Part-time or remote payroll

1. Corporate Incentive Programs

Need a morale or engagement boost at work? Then use virtual cards to offer employee incentive programs such as bonuses, travel perks, and gift cards. They’re cost-effective and sent worldwide via email, making them the perfect option for global companies or remote teams. Additionally, employees can choose their ideal gifts with cards.

2. Marketing and Sweepstakes Campaigns

Virtual prepaid cards make marketing easy. For instance, offer cards as the prize for contests to add value to promotions with minimal effort. Moreover, digital marketing and e-commerce shopping are both in-demand, so adding virtual options for online redemption appeals to customers.

3. Part-time or Remote Payroll

Not all employees work on a full-time basis—many are part-time, gig or remote. So, virtual cards supply these workers who may earn smaller salaries or work on contract. If gig worker is outside of regular payroll, their cards reload any time.

Nikko Pangilinan

Nikko Pangilinan Ray Forzley

Ray Forzley Diana Marie

Diana Marie Lisette Anciaes

Lisette Anciaes Junius Cheng

Junius Cheng  Aysha Shahid

Aysha Shahid Chris Michaelis

Chris Michaelis Mira Tzur

Mira Tzur Jamie Rust

Jamie Rust Dianne Dickens

Dianne Dickens Roy Murad

Roy Murad Huguette Masse

Huguette Masse Lauren Weekes

Lauren Weekes